Five Tips to Finding the Best Auto Insurance Policy

When it comes to auto insurance, finding the perfect policy can be a daunting task. Here are five tips to finding the best policy for you:

1. Compare Costs: One of the most important things to consider when looking for an auto insurance policy is the cost. Shopping around to compare rates and coverage can save you hundreds of dollars a year. To get the best deal, talk to multiple companies and compare their offers. Remember that policy costs vary by province and company.

2. Consider Coverage Features: When shopping for auto insurance, it’s important to think about the features that are most important to you. Do you need comprehensive coverage, or just the bare minimum? Are you looking for additional coverage features, such as roadside assistance or emergency service? Knowing what coverage you need can help narrow down your search and get the right policy for you.

3. Research Reputations: You want to make sure you’re dealing with a trusted auto insurance provider. Do your research to see how other customers have rated the company. Read reviews online and ask family and friends for their opinion. This can help you feel confident in your choice and make sure you’re getting the best deal for you.

4. Understand Deductibles: Deductibles are the portion of an, insurance claim you must pay out of pocket. Depending on the coverage you choose, deductibles can vary, as can premium costs. Knowing how deductibles work and how they affect your policy is an important part of finding the best auto insurance.

5. Ask About Discounts: Many insurance providers offer a variety of discounts to help lower the cost of your policy. Ask about potential discounts, such as those for good drivers, multiple vehicles, or low-mileage drivers. If you’re unsure what discounts are available, talk to your provider for more information.

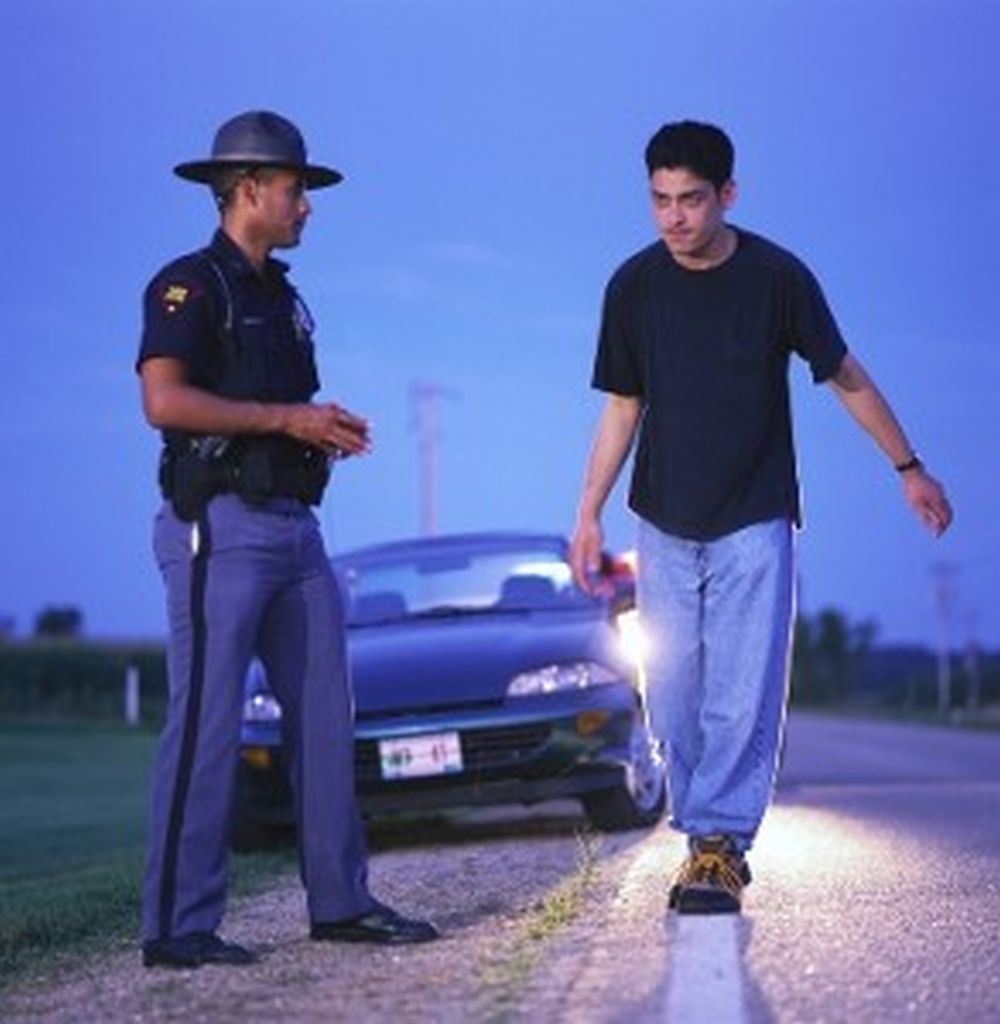

In addition to the above tips, consider enrolling in a defensive driving course to improve your driving skills and potentially reduce your premiums. A good driving record is a major factor when it comes to finding the best auto insurance policy for you.

It’s also important to be realistic when it comes to the coverage you need. Don’t overbuy and don’t skimp on coverage. Talk to an insurance agent to assess your needs and find the right policy for your lifestyle.

There are many different options when it comes to auto insurance. With a little research and some comparison shopping, you can find the best policy that fits your needs and budget. Don’t be afraid to ask questions and remember to shop around to compare prices.

Finally, make sure you read all the fine print before committing to a policy. Pay close attention to coverage limits and exclusions, payment schedules, and any additional fees. Be sure to understand exactly what is and isn’t covered under your policy and talk to your insurer if you have any questions or concerns.

In conclusion, while finding the perfect auto insurance policy can be difficult, taking the time to research your options and understand what coverage you need can save you time and money in the long run. By following the tips laid out above and talking to an insurance agent, you can find an affordable policy that is right for you. From knowing the costs to understanding all the fine print, these steps will help you find the best auto insurance policy and get the best protection for your vehicle.